How Decarbonization Will Transform the Geography of Industrial Production: New Evidence on the “Renewables Pull” Hypothesis

29.12.2023

The availability of renewable energy is an important factor for future investment decisions in the chemical and steel industry. This is a key finding of our survey of 300 decision-makers from the chemical and steel industry. 92 per cent of the respondents anticipate that their company will relocate facilities as it seeks to decarbonize production. In addition to low-cost renewable energies, the respondents identify political support as a key factor in investment location decisions.

Renewable hydrogen is an enabler for the decarbonization of energy-intensive industries, such as the chemical and steel sectors. Together these sectors account for almost 15 percent of global greenhouse gas emissions, making their decarbonization an urgent priority to meet carbon neutrality targets by mid-century (IEA, 2013, 2020). The rapid ramp-up of the production of renewable hydrogen is a crucial challenge in this context and raises important questions with regard to the future geography of climate-friendly industrial production. Existing centers of industrial production are exploring options to secure access to sufficient amounts of renewable hydrogen to decarbonize existing production facilities. At the same time, regions with high levels of renewable potential are examining the possibility of utilizing this as an asset to attract new investment in climate-friendly industrial production.

While this debate has remained largely theoretical to date, a new survey conducted by researchers at the RIFS in Potsdam as part of the GET Hydrogen project provides a first set of empirical data on the phenomenon. In the survey, over 300 managers from the 50 largest chemical and steel companies worldwide described how they anticipate the decarbonization of industry will affect investment decisions in the two sectors by 2050. As industry experts and decision-makers, the respondents are not only uniquely positioned to offer insights into current trends, but their expectations will also influence investment decisions in their companies. In other words, the expectations captured in this survey will shape the industrial landscape on the ground.

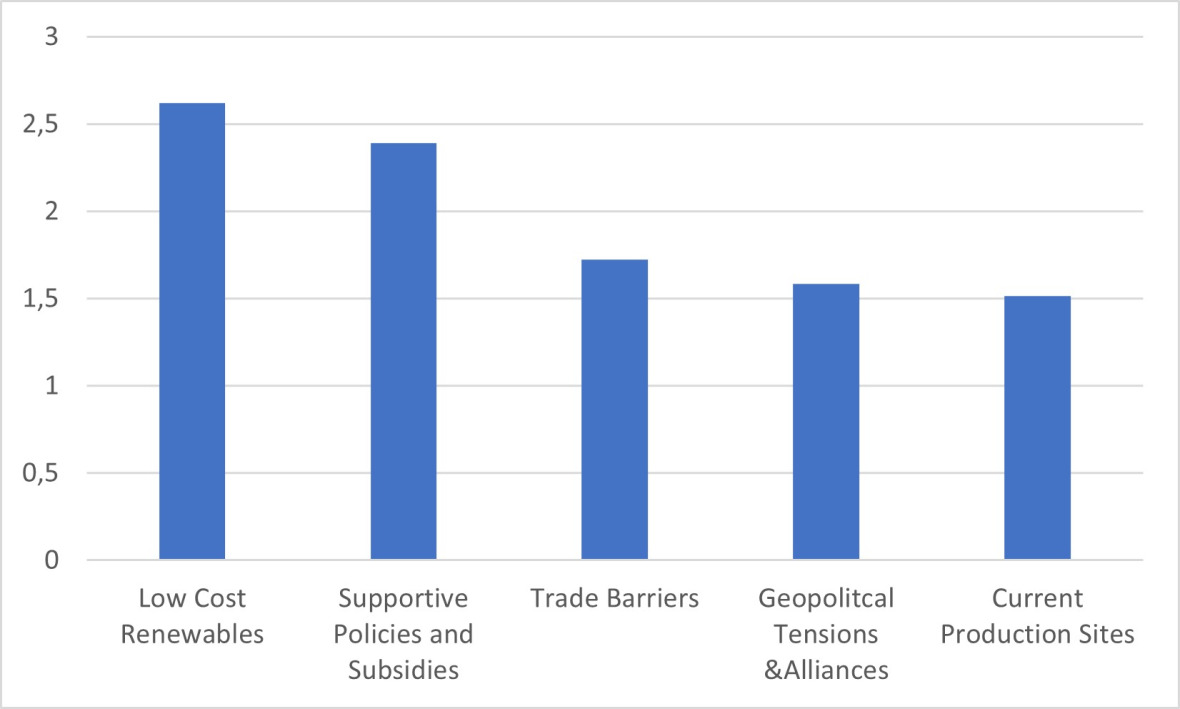

Against this background, the survey’s findings provide a strong confirmation that the availability of renewable energy resources will be an important driver of future investment decisions. Ninety-two percent of respondents are convinced that the use of renewable hydrogen to decarbonize industrial production in the chemical and steel sectors will significantly alter the geographic distribution of production by 2050 within their own company, and 89 percent state that this will apply to the industry as a whole. Furthermore, the managers were asked to rank the most important factors that will influence their investment location decisions by 2050. Managers in both sectors identify renewable energy potential as the most important factor when it comes to investment location decisions. This is followed by supportive policies and access to subsidies; the role of trade barriers; and geopolitical factors (see Figure 1 for the ranking of factors). All of the above-mentioned factors are seen as more important than the current production sites, proximity to consumer markets, workforce skills and costs, or capital costs and favorable investment conditions (see Figure 1).

Figure 1: Manager’s ranking of the five most important factors influencing investments in their sector by 2050.

These findings contribute new empirical evidence to the debate on how value creation might shift as a result of industrial decarbonization. We see three main implications that will be relevant for industrial stakeholders and policymakers alike:

Renewables pull effect: renewables will shape investment location decisions. The ‘renewables pull effect’ describes the potential role that the availability of low-cost renewable energy could have in attracting investment in climate-friendly industries that rely on renewable energy sources. Previous studies have highlighted that coastal areas with favorable wind conditions or regions with high solar irradiation, for example, could see significantly lower marginal costs for renewable energy, which might trigger industrial relocation to those regions to capitalize on this advantage (A. Eicke et al., 2022; Eicke & De Blasio, 2022; L. Eicke et al., 2022; Samadi et al., 2023). However, until now this has been a purely theoretical debate, and it remains an open question what role renewable energy plays in complex investment decisions and how they compare to other important factors, such as labor and capital costs, infrastructure, and network effects in industrial clusters (Verpoort et al., 2023). Our study highlights that managers rate renewable energy sources as more important than these other factors.

Strategic industrial policies can shift investments. Green industrial policy is experiencing a revival, with policy playing a catalyzing role for nascent green hydrogen markets (ISPI, 2023). Such policy frameworks are expected to strongly influence investment decisions in the steel and chemical sectors. This pull effect is demonstrated by increased investment in the US following the passage of the Inflation Reduction Act (Gruenig, 2023), which provides generous tax breaks for investments in various clean technologies. While the rules governing investments in hydrogen production are yet to be finalized, it is certain that they will significantly lower the costs for clean hydrogen producers in the US. This has led several large European companies such as Enel, Volkswagen, BMW, NEL, and Freyr to expand around 20 clean energy manufacturing plants in the US (Collins, 2023; Wessner & Khemka, 2023). The recent RIFS discussion paper series analyzes hydrogen strategies and related industrial policies across key countries worldwide, including China (Gong et al., 2023), the US, the EU (Zabanova, 2023) and several Member States as well as a number of African countries such as Morocco, Algeria (Weko et al., 2023) and Namibia (Cassidy & Quitzow, 2023). A nuanced understanding of country-level assets, including potential for renewable hydrogen production as well as know-how, infrastructure and other factors, will be important in defining specific and strategic industrial policies for different country types, such as potential hydrogen exporters with good resource conditions, industrialized import dependent countries or countries that hope to attract green industries within this transition (Eicke & De Blasio, 2022).

Geopolitical dynamics shape future industrial value chains and vice versa. Geopolitical considerations, ranking third in the survey, are another key factor shaping the geography of future industrial production. Geopolitics plays an important role in ensuring a secure supply of renewable hydrogen and is significantly influencing strategies for the development of hydrogen imports in the EU (Zabanova, 2023) and key EU Member States (Nunez & Quitzow, 2023). However, not only does geopolitics shape investment decisions along industrial value chains, changing value chain dynamics might also create new geopolitical tensions. Large economies such as China, the US and EU have launched costly subsidy schemes as they compete for green technology leadership. Smaller economies in the Global South will face stronger budget constraints when it comes to such policy interventions, raising significant just transition concerns (Eicke & De Blasio, 2022; Eicke & Goldthau, 2021). This is likely to intensify debates around the need for finance and technology transfer to support green industrial development in the Global South.